Samples of Significant Transactions:

- Buckhead Submarket, Atlanta, GA – $1 billion of transaction volume

- 1180 Peachtree, Midtown Atlanta, GA – landmark office transaction

- Charleston, SC – key land transactions on the Peninsula

- Buckhead Station, Atlanta, GA – 8 separate transactions for major retail projects

- Flournoy Portfolio, Southeast, USA – 4,049 garden apartment portfolios

- Regent Portfolio – portfolio recapitalization (mixed use)

- The Terraces – Office Deal of the Year 2013

- The Omni Hotel – The site of this trophy asset exceeded $300 million

Office | 1180 Peachtree Road, AtlantaKing & Spalding Building, Midtown, Atlanta Bullock Mannelly Partners represented GE Asset Management in the acquisition of this core asset. Additionally, BMP was retained by GE Pension Trust to provide long-term permanent debt of approximately $193,000,000 in order to facilitate the acquisition. 1180 Peachtree is approximately 85% leased to King & Spalding for a 15 year term. The project was developed by Hines and is considered Atlanta’s Top Trophy Asset. The transaction set the market and was office transaction of the year in Atlanta. |

Land | Charleston, South Carolina4 Sites (480+ Acres) BMP has played a significant role in structuring the acquisition of land for the redevelopment of strategic key sites on the peninsula of Charleston, SC. BMP Partners helped assemble the capital and development teams to provide for the future redevelopment of key sites on some of the few remaining sites on the peninsula of Charleston, SC. The locations will eventually support in excess of $1 billion in new development. (A) Ashley River Center – 56 Acres |

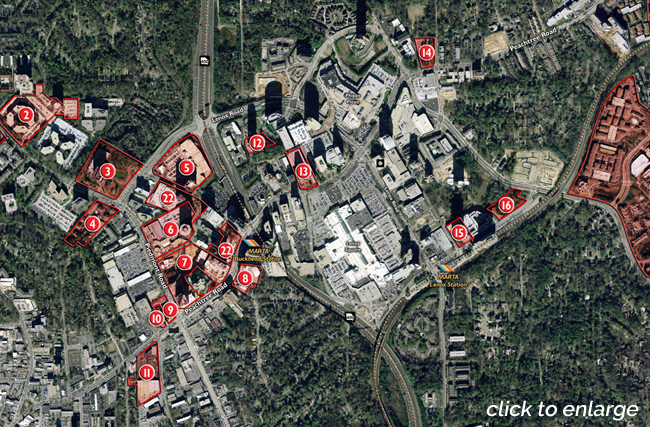

Retail | Buckhead Station, AtlantaJoint Venture | Investment Sale | Finance BMP structured a joint venture for the development of one of the the most strategic shopping centers in the Atlanta market, located at Buckhead Loop and I-400. BMP facilitated 8 separate transactions for Buckhead Station which included: • Original Land Sale Venture |

Multiple Sites | Tower Place, AtlantaMultiple Sites: Office, Residential, Hotel, Assisted Living, Land BMP enabled Regent Partners, one of Atlanta’s premier development companies, to recapitalize its portfolio which included 928,000 S.F. of office space, 935 hotel rooms, 830 apartment/condo units, 60 assisted living units and 131 acres of land. BMP structured a transaction between Regent Partners and one of North America’s largest hedge funds, resulting in a buy out that allowed Regent’s to acquire the interest of their current partner and form a new venture of 18 assets valued at over $126 million. The premier assets, located in the Buckhead submarket of Atlanta, included the prestigious Tower Place Building and its adjacent land. BMP partners underwrote each asset and executed the subsequent sale of many of the assets purchased by the new venture. |

Multifamily | Flournoy PortfolioSoutheast/Western USA: 4,049 units (13 Separate Communities) MP structured the purchase of $400 million +/- of assets comprised of 4,049 units (13 separate communities) across the Southeast and Texas through two institutional equity sources in an off market transaction. |

Office | The Terraces, Atlanta, Perimeter MarketSquare Feet: 1,000,000 Bullock Mannelly Partners negotiated the sale of twin trophy office towers containing over 1 million square feet in North Atlanta for $190 million. BMP was selected by Royal Bank of Scotland to co-market this trophy asset. Metropolitan Life Insurance acquired the asset. This landmark transaction was the Office Deal of the Year. |